Introduction

University and other institutional endowments have similar investment goals to many individual investors. First, don’t lose money. Second, generate returns that allow the asset base to grow, even after making required annual distributions. With highly similar investment goals, why do endowments have substantially different portfolio allocations than most individual investors? And what can we learn from endowments?

The Endowment Model

The endowment model of investing is a strategy pioneered by David Swensen for Yale University, which has since been widely adopted by many universities and pension funds. The endowment model emphasizes a long-term, equity-oriented approach, with significant allocations to alternative investments such as private equity, hedge funds, and real assets. This model contrasts with traditional high-net-worth portfolios that focus heavily on long-only public equities and fixed-income securities.

Key Principles

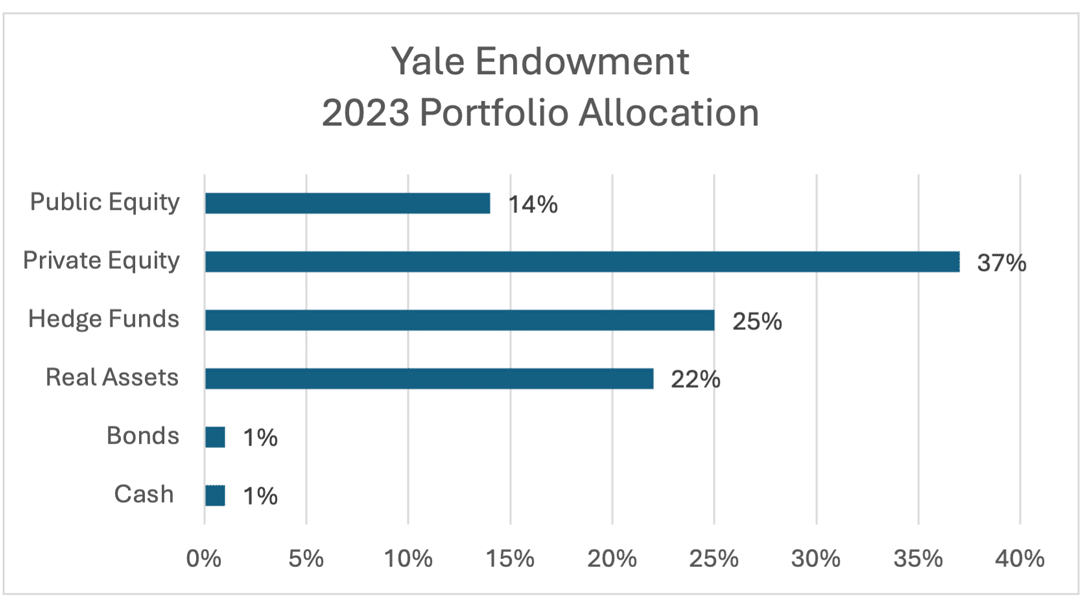

Endowments are defined by two central objectives: preserve capital and grow capital, while providing 3%-5% annual distributions. To achieve these objectives, the endowment model relies on broad diversification across asset classes. This approach produces portfolios that are more heavily invested in private equity and hedge funds, and less heavily invested in public equities and bonds than most individual investor portfolios. Yale, for example, allocates 37% of its endowment to private equity funds, and 25% to hedge funds (many of which are long-short equity funds).

In addition, endowments emphasize equity-like investments due to their higher expected returns over time. This focus aligns with the long-term nature of the institutions’ objectives, where short-term liquidity is less of a concern compared to growing the capital base over the long run. The perpetual nature of endowments allows for a longer investment horizon. Moreover, having a long-term target policy portfolio creates an annual rebalancing discipline that is necessary to fully capture diversification benefits.

Benefits of the Endowment Model

- Enhanced Returns: Consistent exposure to alternative investments and actively managed strategies delivers higher returns over complete market cycles.

- Risk Management: Diversification across uncorrelated asset classes reduces portfolio volatility and protects against systemic risks.

- Inflation Hedging: Real assets provide a natural hedge against inflation, preserving the purchasing power of the portfolio.

Applicability to Individual Investor Portfolios

Despite significant benefits, few high-net-worth investor portfolios resemble the endowment model. There are several historical reasons why.

- Limited Access: High investment minimums and a general aversion to high fees create an environment where few individual investors have access to an attractive and comprehensive suite of private equity and hedge funds.

- Poor Manager Selection: Most endowments have proven themselves adept at identifying asset managers who beat long-term industry averages. Poor manager selection by individuals with limited expertise can significantly impact performance.

- High Taxes: Many hedge funds are designed for non-taxable investors. These funds produce high pre-tax returns, but they also produce substantial short-term capital gains for taxable investors. This characteristic makes many hedge funds less attractive to most individual investors.

Implications

The benefits of the endowment model are significant, but because of limited access, manager dependencies, and high tax burdens, these benefits have not been easily capturable in the past by high-net-worth individual investors. This limitation is gradually changing. A handful of hedge funds have emerged that are designed to produce endowment-like results with taxable investors in mind. A subset of these funds is predicated on systematic exposure to core investment principles that consequently have far less reliance on manager selection and skill. Many high-net-worth investors might be well-served to consider replicating endowment model allocations in their own portfolios, being sure to invest in products that are accessible, minimize manager selection risk, and are designed for taxable investors.